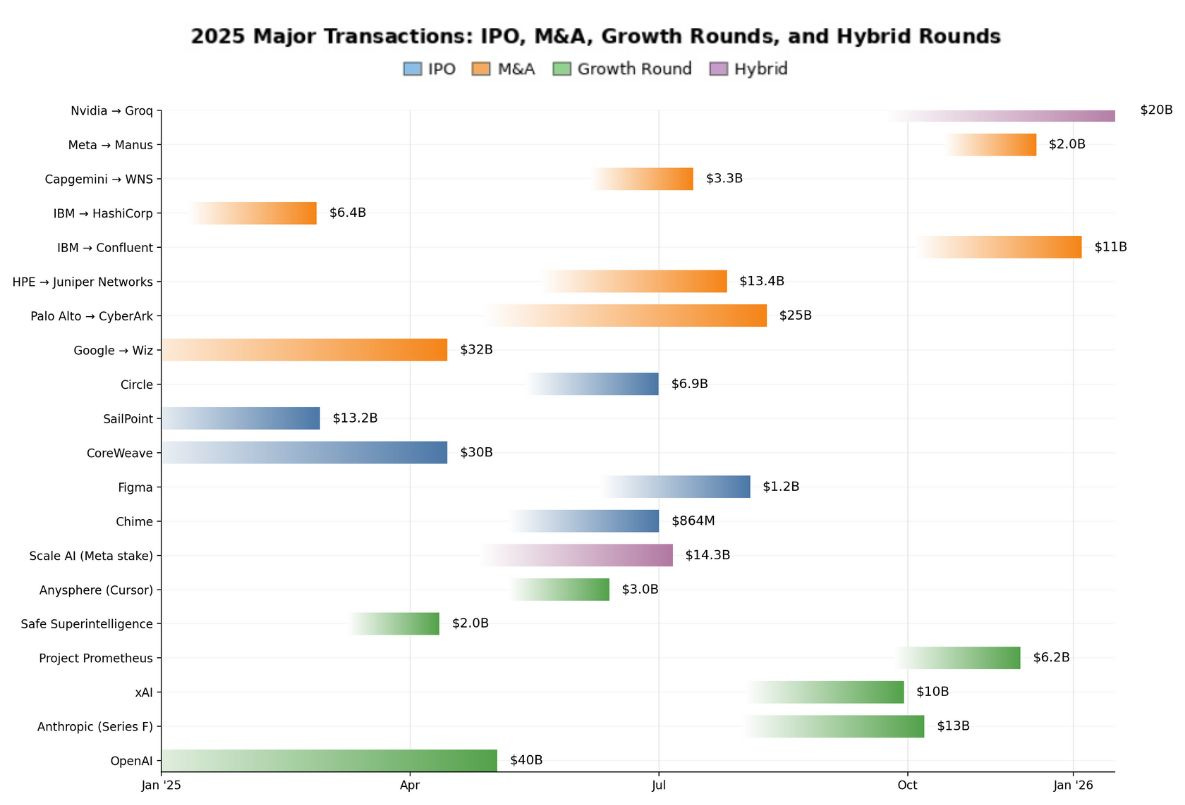

The most striking feature of 2025’s deal activity is the overwhelming dominance of M&A transactions at $478B, up 74% from 2024 M&A activity. M&A in 2025 were defensive moves driven by fear of being left behind by:.

Being structurally late to AI: Building internally was slower than acquiring.

Losing pricing power: As AI commoditizes features, owning differentiated data, workflows, or distribution becomes essential to defending margins.

Talent scarcity at the frontier: Elite AI and security teams remain incredibly hard to hire. Acquisitions are one of the few ways to secure them at scale.

Google’s $32 billion acquisition of Wiz stands out as a watershed moment for what it signals about enterprise security’s strategic importance.

Similarly, IBM’s with its $11 billion Confluent acquisition and $6.4 billion HashiCorp deal and Meta <> Manus deal demonstrates how legacy tech giants are buying their way into modern infrastructure markets to add agentic orchestration and full stack workflows.

Nvidia’s $20 billion acquisition of Groq and Meta’s $14B by ScaleAI illustrates another trend: the blurring lines between traditional deal structures. This hybrid approach suggests that companies are getting creative with deal mechanics to navigate regulatory scrutiny while still achieving strategic objectives in the hot AI chip market.

More IPOs in 2026

2025 had a few IPOs: CoreWeave ($30B), SailPoint ($13.2B), Circle ($6.9B), Figma ($19B), Chime ($11B).

The companies that did go public represent interesting case studies. CoreWeave’s success reflects the insatiable demand for AI infrastructure, while Circle’s IPO validates the maturation of crypto infrastructure beyond speculative tokens.

While IPOs aren’t dead and we will see a lot more of them in 2026, large M&A deals are leading to faster liquidity options for founders and investors. The traditional VC investor journey from investment to IPO is not the only path to liquidity. The more accurate framing is that we’re entering an era of exit optionality. The best companies have multiple paths to liquidity, and the choice between M&A and IPO increasingly depends on market timing, strategic fit, and founder preferences rather than one universally superior option.